How do you discharge a student loan in bankruptcy?

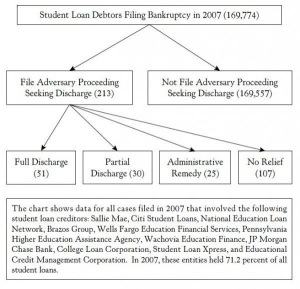

According to a student loan bankruptcy study conducted by Jason Iuliano, a Princeton political science Ph.D. candidate who has a degree from Harvard Law School, nearly 40% (4 out of 10) of debtors who request student loan discharge in bankruptcy is approved in a court of law. The study also concluded that the Student Loan Debtors that did not attempt to get a discharge looked financially similar to the Student Loan Debtors that did receive a student loan discharge. In other words, they should have tried to seek a student loan discharge.

According to a student loan bankruptcy study conducted by Jason Iuliano, a Princeton political science Ph.D. candidate who has a degree from Harvard Law School, nearly 40% (4 out of 10) of debtors who request student loan discharge in bankruptcy is approved in a court of law. The study also concluded that the Student Loan Debtors that did not attempt to get a discharge looked financially similar to the Student Loan Debtors that did receive a student loan discharge. In other words, they should have tried to seek a student loan discharge.

While the odds of discharge seem pretty good, Iuliano states, “99.9 percent of student loan debtors in bankruptcy never attempt to get a discharge.”

While filing for Chapter 7 or Chapter 13 bankruptcy will wipe away many of your consumer debts (like outstanding medical bills or even a mortgage), your student loan debt is exempt from the same treatment unless you can prove an “undue hardship”.

Chapter 13 bankruptcy could help provide relief from paying off your student loan debt in the short term with reduced monthly payments, but you’d still be on the hook for whatever loan balance is left after your bankruptcy repayment period ends. Similarly, you’re still on the hook for your student loan debt if you file for Chapter 7 bankruptcy.

When and How can I discharge my student loans?

In general, it’s really challenging to discharge your student loans through a normal bankruptcy process. Bu t there is hope that this trend could reverse: A 2013 court case created precedence for partially discharging student loans. By filing a separate lawsuit within the bankruptcy case, the plaintiff was able to prove that his student loans created “undue hardship.” Undue hardship is now defined as the “Brunner Test”.

t there is hope that this trend could reverse: A 2013 court case created precedence for partially discharging student loans. By filing a separate lawsuit within the bankruptcy case, the plaintiff was able to prove that his student loans created “undue hardship.” Undue hardship is now defined as the “Brunner Test”.

To start the process, you first need to formally file for Chapter 7 or 13 bankruptcy. At first, the court will deny your request to discharge your student loans in the bankruptcy filing and will have to file a separate adversary proceeding and prove repayment of your student loans would cause an undue hardship.

According to the Federal Student Aid website, the court uses three factors to determine undue hardship (Brunner Test):

- You wouldn’t be able to maintain a minimal standard of living if you were forced to repay the loan.

- Your financial hardship would continue for a significant portion of the repayment period if you were forced to repay the loan.

- You’ve made a good-faith effort to repay the loan before you filed for bankruptcy.

All of this involves a lawsuit, legal fees, and court battles – and your student loan creditor may fight you back against these charges. But if your student loan is discharged, you won’t have to repay any of the loan.

But before filing bankruptcy it’s important to consider all of your options when trying to eliminate your student loan debt, like income-based repayment (IBR) or even student loan forbearance. You can also get a portion of your student loan debt discharged via Public Service Loan Forgiveness by working in a certain industry.

For example, if you are a teacher in a low-income elementary or secondary school, for example, you could have your federal student loans discharged after 5 years of work. Similarly, if you’re employed in the public service sector, you could have your loans forgiven after 10 years of consecutive work and payments.

Delaware bankruptcy attorney Timothy J. Weiler has helped several clients successfully discharge student loans in bankruptcy. Contact Tim today for a free consultation to discuss your student loan debt relief options.